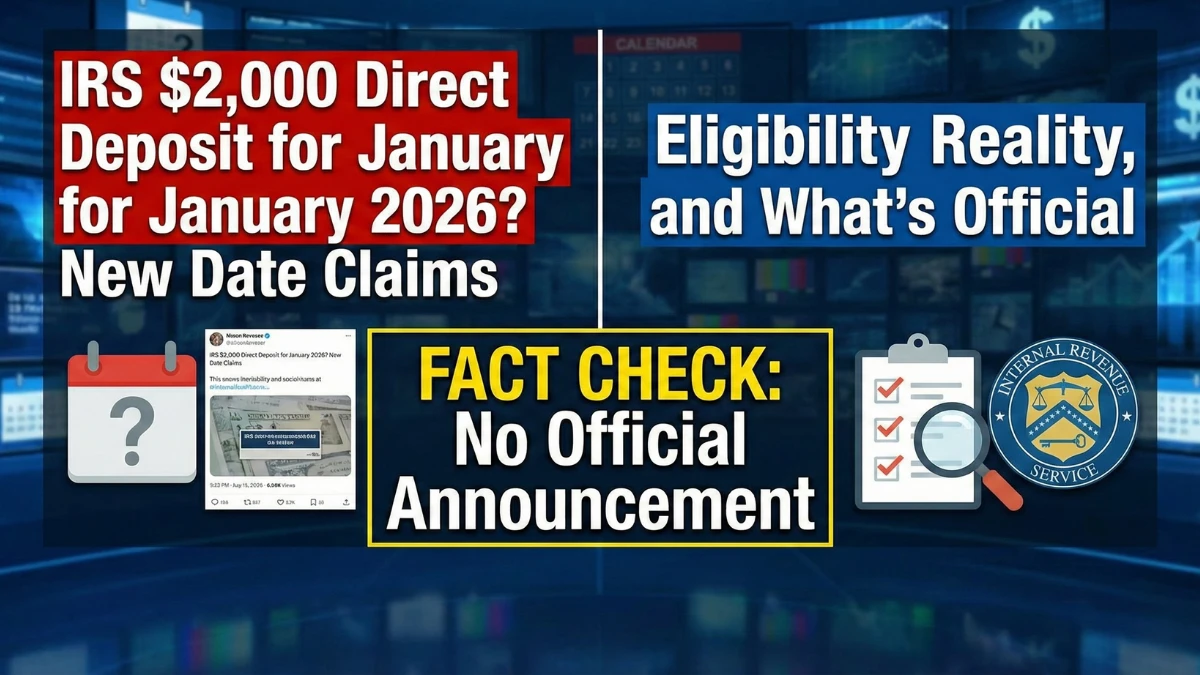

Headlines claiming an IRS $2,000 direct deposit for all Americans in January 2026 are spreading fast, often paired with supposed payment dates and eligibility guides. These claims blend past stimulus language with early tax-season expectations, creating confusion about what is actually approved. This article explains what’s confirmed, what’s not, and how any real payment would work according to the Internal Revenue Service.

Is an IRS $2,000 Direct Deposit for All Approved in January 2026?

No. There is no approved IRS program authorizing a $2,000 direct deposit for all recipients in January 2026. Any nationwide payment would require Congressional legislation, funding authorization, and published IRS guidance. None of these steps have occurred for a new $2,000 payment.

| Claim Area | What’s Being Said | Verified Status |

|---|---|---|

| Payment Amount | $2,000 for all | Not authorized |

| January 2026 Dates | Announced | No official schedule |

| Eligibility | Everyone qualifies | Not applicable |

| IRS Approval | Completed | No announcement |

| Automatic Deposit | Guaranteed | No program exists |

Why “For All” and January Dates Keep Appearing

January is frequently used in payment rumors because it coincides with tax season preparation, annual adjustments, and fiscal-year resets. These routine events are often mistaken for new payments, even when no law or official notice exists. The phrase “for all” is especially misleading, as past federal payments have never been universal without income limits.

Eligibility Guide: Who Would Qualify If Approved?

If Congress were to approve a $2,000 IRS direct deposit, eligibility would likely follow earlier relief models. That typically includes income thresholds, filing status requirements, residency rules, and phase-outs, meaning not everyone would qualify and higher-income households could receive reduced or no payments.

New Payment Dates: What’s Real and What’s Not

There are no confirmed payment dates for a $2,000 IRS deposit in January 2026. When legitimate payments are approved, the IRS publishes clear schedules in advance and issues payments automatically via direct deposit or mailed checks using tax records.

What Payments Are Actually Legitimate in Early 2026

In early 2026, the IRS is expected to issue tax refunds and refundable credits tied to filed returns, along with benefits already authorized under existing law—not a new $2,000 direct deposit for all.

What You Should Do Right Now

There is nothing to apply for or claim regarding a $2,000 deposit. Do not click links, pay fees, or share banking details to “secure” a payment. Legitimate IRS payments are announced publicly and do not require upfront action.

Key Facts to Remember

- NO $2,000 IRS direct deposit for all is approved

- NO January 2026 payment dates are confirmed

- Eligibility rules are not published

- Refunds explain most early-year deposits

- “For all” claims are misleading

Conclusion

Despite viral headlines, IRS $2,000 direct deposits for all Americans are not scheduled for January 2026. Until Congress authorizes a payment and the IRS releases formal guidance, Americans should rely only on official updates and treat $2,000 payment claims as speculation.

Disclaimer

This article is for informational purposes only and does not constitute financial, legal, or tax advice. Always verify payment information through official government sources.