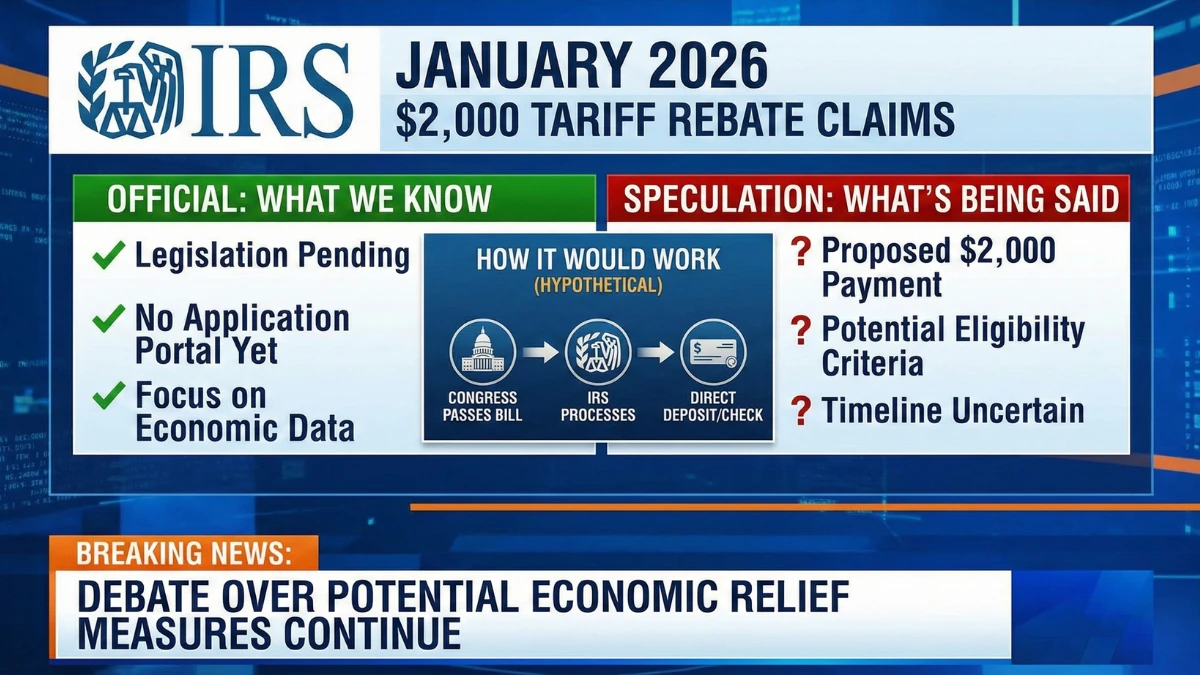

Claims that the IRS will issue a $2,000 direct deposit tariff rebate in January 2026 are circulating widely, leaving many Americans unsure whether a new payment has been confirmed. These reports often mix policy proposals with routine tax-season activity. This article clearly explains what has been verified, what has not been approved, and how such a payment would actually work under guidance from the Internal Revenue Service.

What Is the $2,000 Tariff Rebate Being Discussed?

A tariff rebate refers to the idea of returning revenue collected from import tariffs directly to consumers. While this concept appears in political discussions and opinion commentary, it is not an active federal program and has no enacted law authorizing payments in January 2026.

| Topic | What’s Being Claimed | Verified Status |

|---|---|---|

| Payment Amount | $2,000 | Not authorized |

| Funding Source | Tariff revenue | No law passed |

| IRS Direct Deposit | Scheduled | No program exists |

| January 2026 Timing | Confirmed | No dates issued |

| Federal Approval | Completed | Not approved |

What’s Actually Confirmed

As of now, there is no legislation or executive order approving a $2,000 tariff rebate. The IRS has not announced any new direct deposit, rebate, or stimulus tied to tariffs or January 2026. Without Congressional authorization, the IRS cannot issue such payments.

What’s Not Confirmed (Despite Headlines)

Claims that deposits are guaranteed, eligibility rules are finalized, or funds are already set aside are not supported by official guidance. The IRS cannot create or distribute new payments independently.

How It Would Work If a Tariff Rebate Were Approved

If Congress approved a tariff rebate in the future, the process would include funding authorization, eligibility rules, and formal IRS guidance. Payments would likely be issued automatically via direct deposit or mailed checks using existing tax records, similar to past federal relief programs.

Who Would Likely Qualify

Eligibility would almost certainly include income thresholds, filing status requirements, residency rules, and phase-outs, meaning the payment would not be universal and higher-income households could receive reduced or no amounts.

Is There an Application or Signup Process?

No. Because no program exists, there is no application, enrollment, or deadline. Historically, authorized federal payments are automatic. Any website asking people to apply, pay fees, or provide banking details should be treated cautiously.

Key Facts to Remember

- NO $2,000 tariff rebate is approved

- NO IRS direct deposits are scheduled

- NO January 2026 payment timeline exists

- Eligibility rules have not been published

- Most claims remain speculative

Conclusion

The IRS January 2026 $2,000 direct deposit tariff rebate remains a proposal, not a confirmed payment. Until Congress authorizes a program and the IRS releases formal guidance, Americans should rely only on official announcements and treat tariff rebate claims as unverified.

Disclaimer

This article is for informational purposes only and does not constitute financial, legal, or tax advice. Always verify payment information through official government sources.