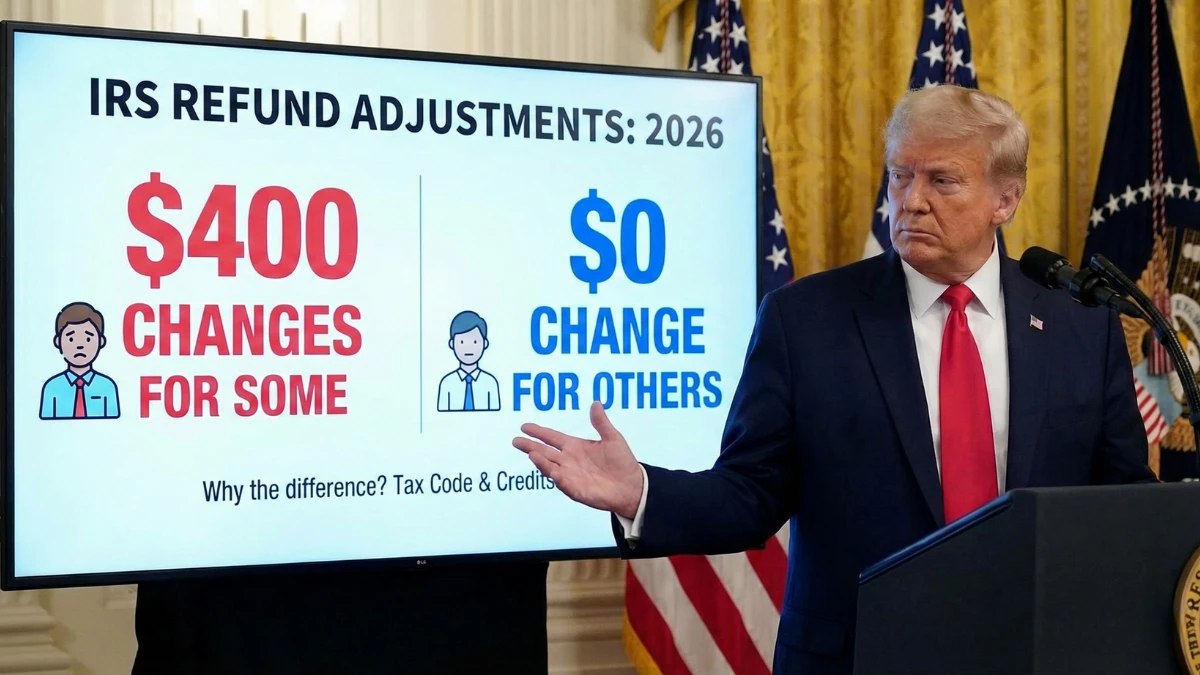

In the 2026 tax season, a growing number of filers are noticing IRS refund adjustments of around $400, while others with similar returns see no change at all. These differences are causing confusion and concern, especially when refunds are reduced or increased without obvious explanation. This article explains why refund adjustments happen, how the Internal Revenue Service makes corrections, and why only certain taxpayers are affected.

What Are IRS Refund Adjustments in 2026?

An IRS refund adjustment occurs when the IRS corrects or recalculates part of a tax return after it is filed. These adjustments can increase or decrease a refund and are often the result of automatic system checks rather than audits or penalties.

| Adjustment Cause | What It Means |

|---|---|

| Math Corrections | IRS fixes calculation errors |

| Credit Changes | Eligibility adjusted automatically |

| Income Matching | Employer data differs from return |

| Withholding Review | Reported taxes revalidated |

| Duplicate Claims | Credits already applied elsewhere |

Why $400 Is a Common Adjustment Amount

Refund changes near $400 often reflect partial credit corrections, minor withholding mismatches, or phaseout calculations. These amounts are large enough to be noticeable but small enough to result from automated fixes rather than full reviews.

Why Some Taxpayers See Adjustments and Others Don’t

Not all returns trigger IRS correction systems. Filers who reported income and credits that perfectly matched IRS records typically see no changes, while even small discrepancies on other returns can prompt adjustments.

Does an Adjustment Mean You Did Something Wrong?

No. Most refund adjustments are routine corrections, not signs of wrongdoing. In many cases, the IRS corrects errors without requiring any action from the taxpayer, especially when documentation supports the change.

How Adjustments Affect Refund Timing

When a refund is adjusted, processing may take additional time while the correction is finalized. Once completed, the revised refund amount is issued via direct deposit or check.

How Taxpayers Are Notified

The IRS typically sends a notice or explanation letter outlining the adjustment. Some changes appear in refund trackers before the letter arrives, which can cause temporary confusion.

What Taxpayers Should Do Next

Taxpayers should review any IRS notice carefully. If the adjustment is correct, no action is needed. If there is a disagreement, the notice explains how to respond or appeal within a specified timeframe.

Key Facts to Remember

- $400 refund changes are usually automatic corrections

- Most adjustments are not audits

- Only returns with discrepancies are affected

- IRS notices explain the reason

- Refund timing may be slightly delayed

Conclusion

IRS refund adjustments in 2026—often around $400—are typically the result of routine corrections, not penalties or audits. Differences in income reporting, credit eligibility, and withholding explain why some taxpayers see changes while others don’t. Understanding how and why these adjustments occur can help filers avoid unnecessary worry.

Disclaimer

This article is for informational purposes only and does not constitute tax or legal advice. Tax situations vary by individual. Always rely on official IRS notices or consult a qualified tax professional.