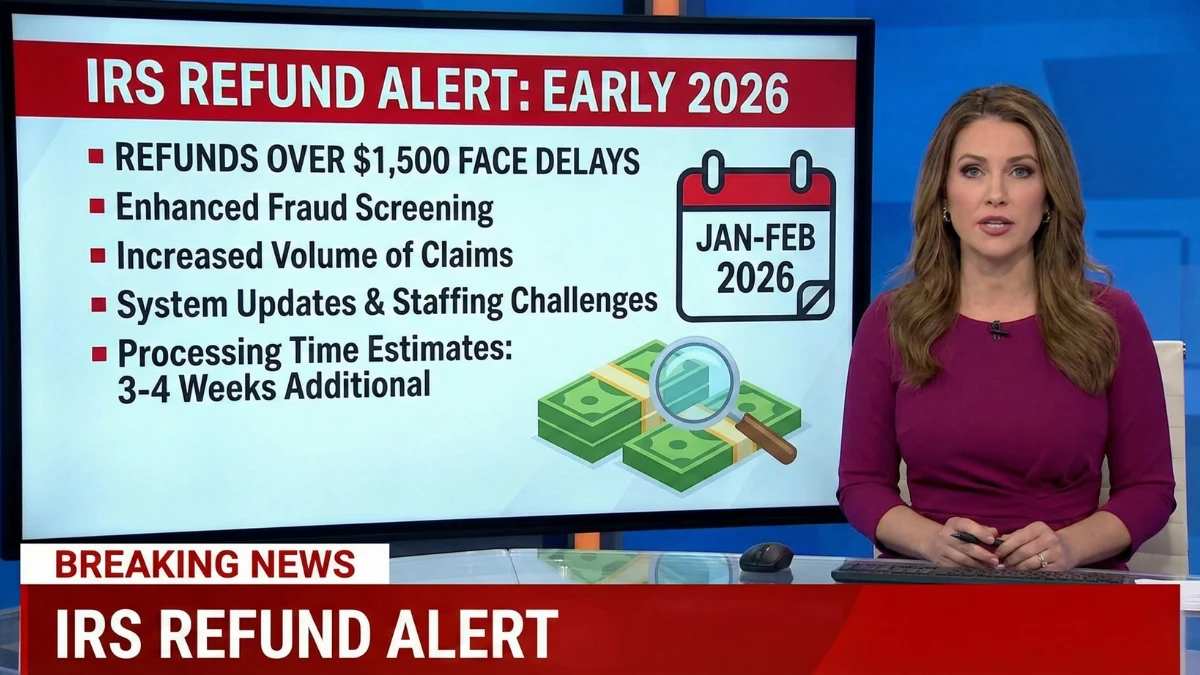

Why IRS Refunds Over $1,500 Are Taking Longer in Early 2026 — What Taxpayers Should Know

In early 2026, many taxpayers are noticing that IRS refunds above $1,500 are taking longer than expected to clear, even when returns are filed electronically. This delay has raised concerns about processing rules, verification checks, and whether larger refunds face extra scrutiny. This article explains why higher refund amounts often move more slowly, what’s normal … Read more