IRS Notices Trigger Questions for Taxpayers Expecting $1,800+ Refunds

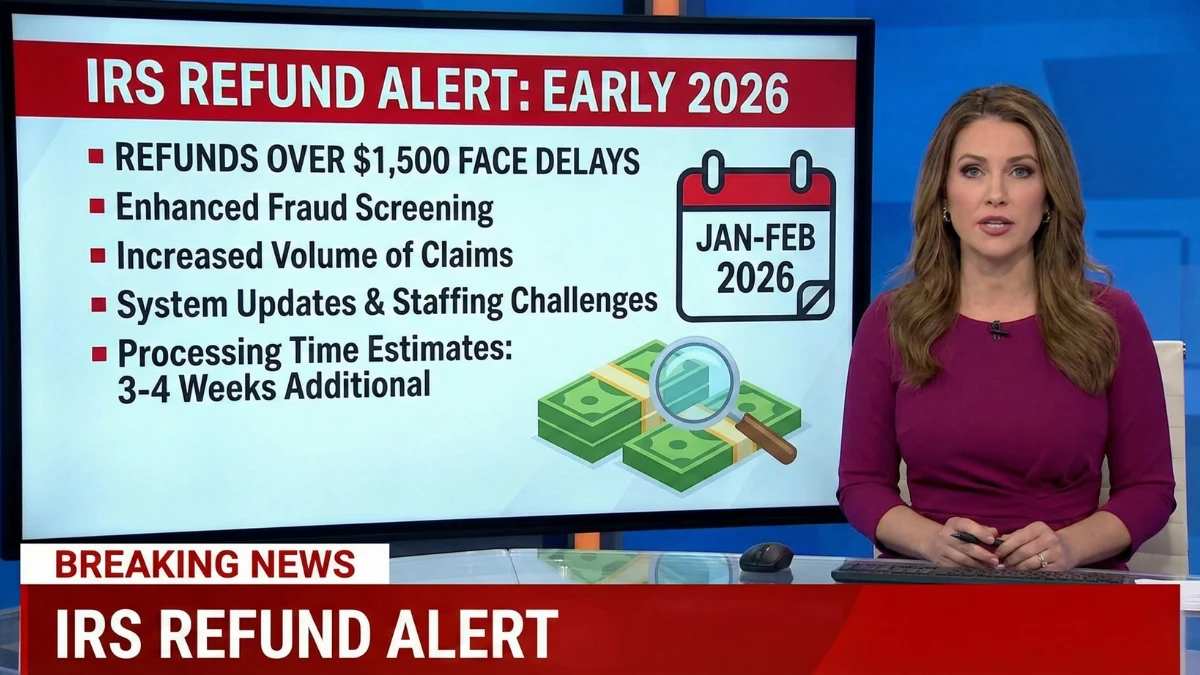

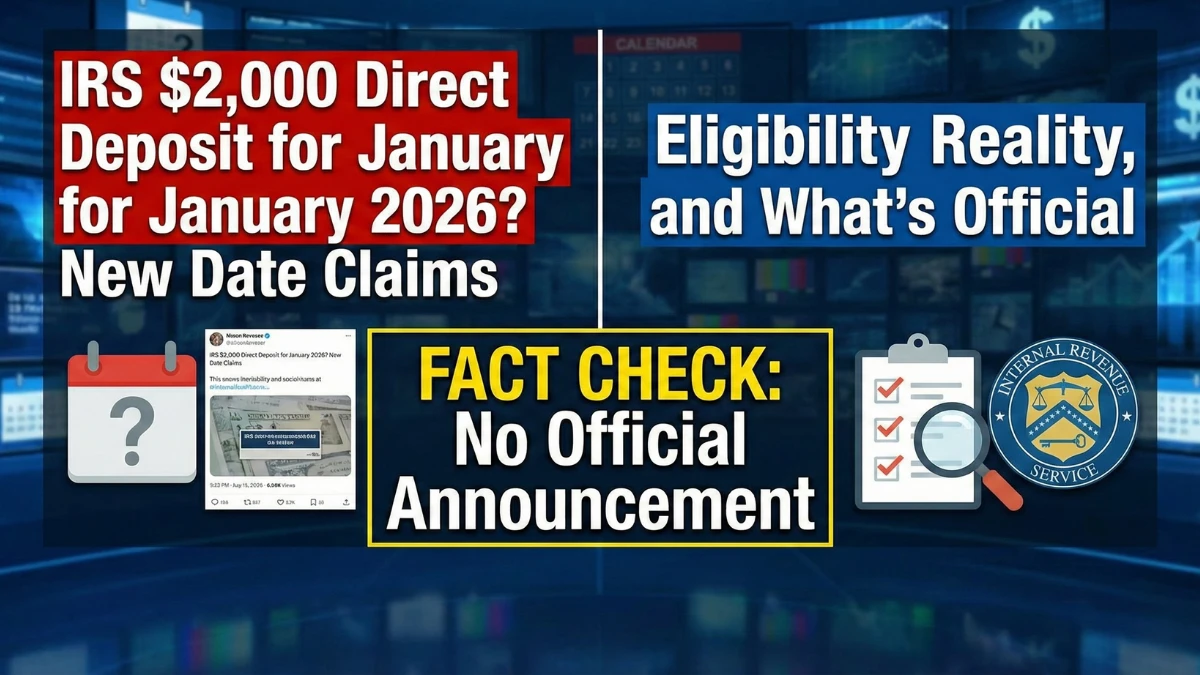

An increasing number of taxpayers expecting $1,800 or higher tax refunds are reporting unexpected IRS notices, leading to confusion about whether their refunds are delayed, reduced, or at risk. This article explains why these notices are being issued, what they actually mean, how the Internal Revenue Service handles refund reviews, and what taxpayers should do … Read more