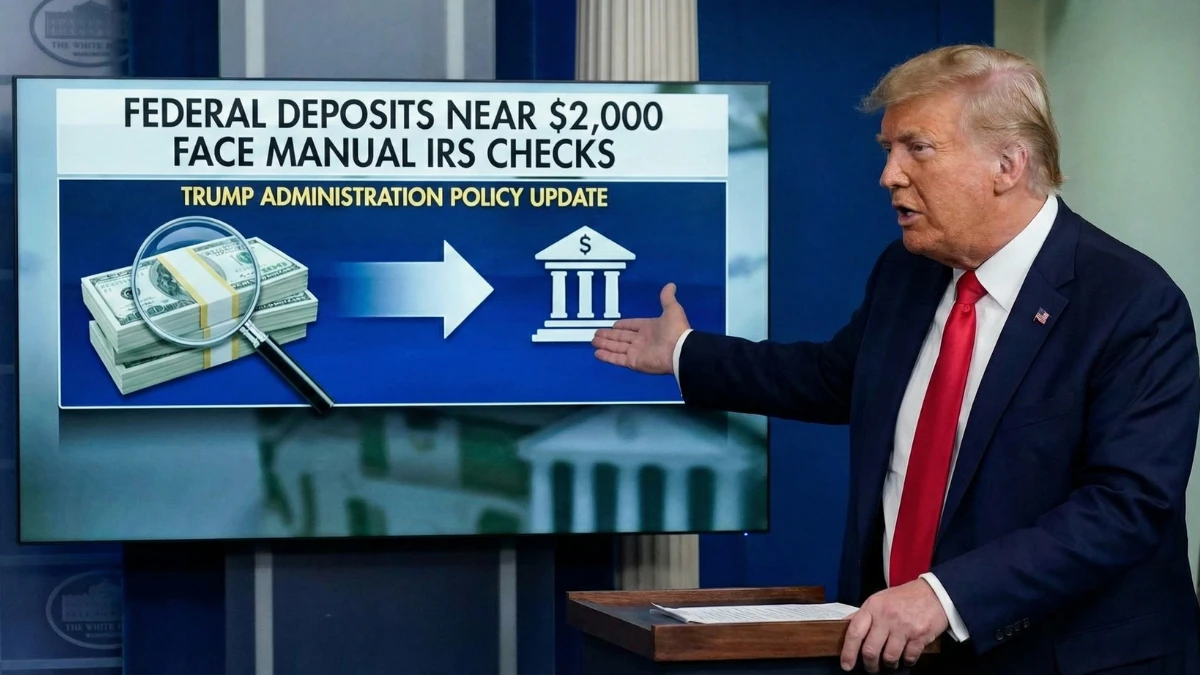

Why Larger IRS Refunds Take Longer in 2026 — Inside the $2,800–$3,500 Delay Window

During the 2026 tax season, many filers expecting $2,800–$3,500 refunds are noticing longer wait times compared with smaller deposits, leading to questions about refund status and processing delays. This article explains why refunds in this range often take extra time, how the Internal Revenue Service reviews returns, and what taxpayers should realistically expect while waiting. … Read more