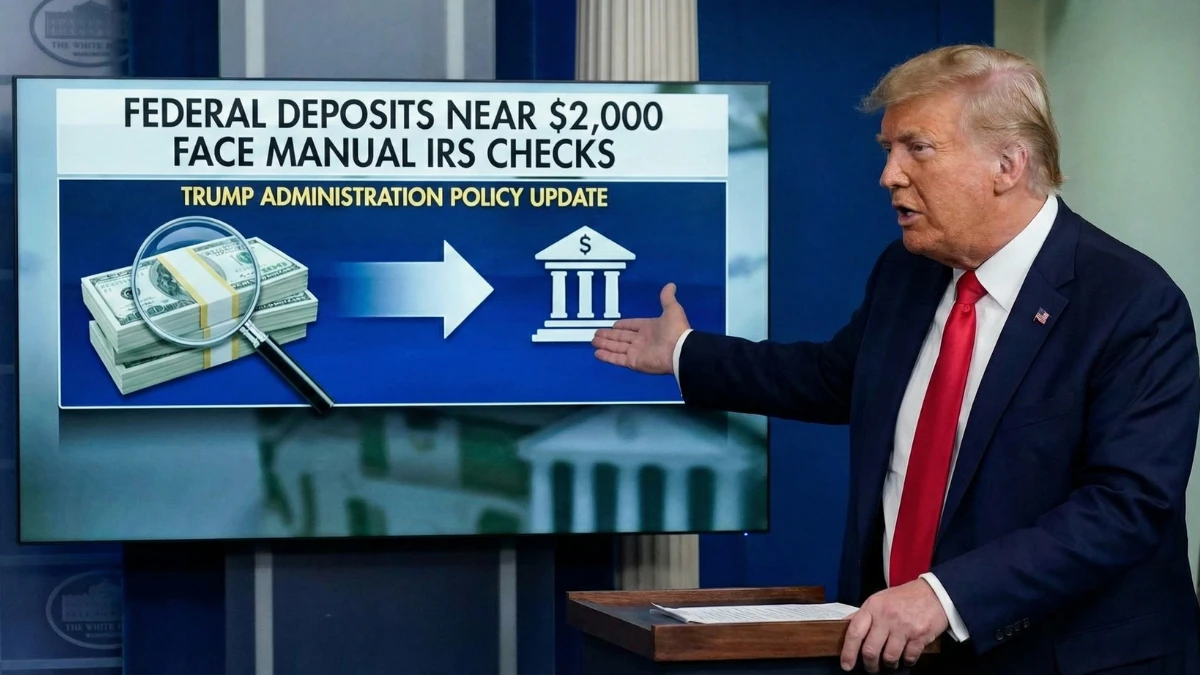

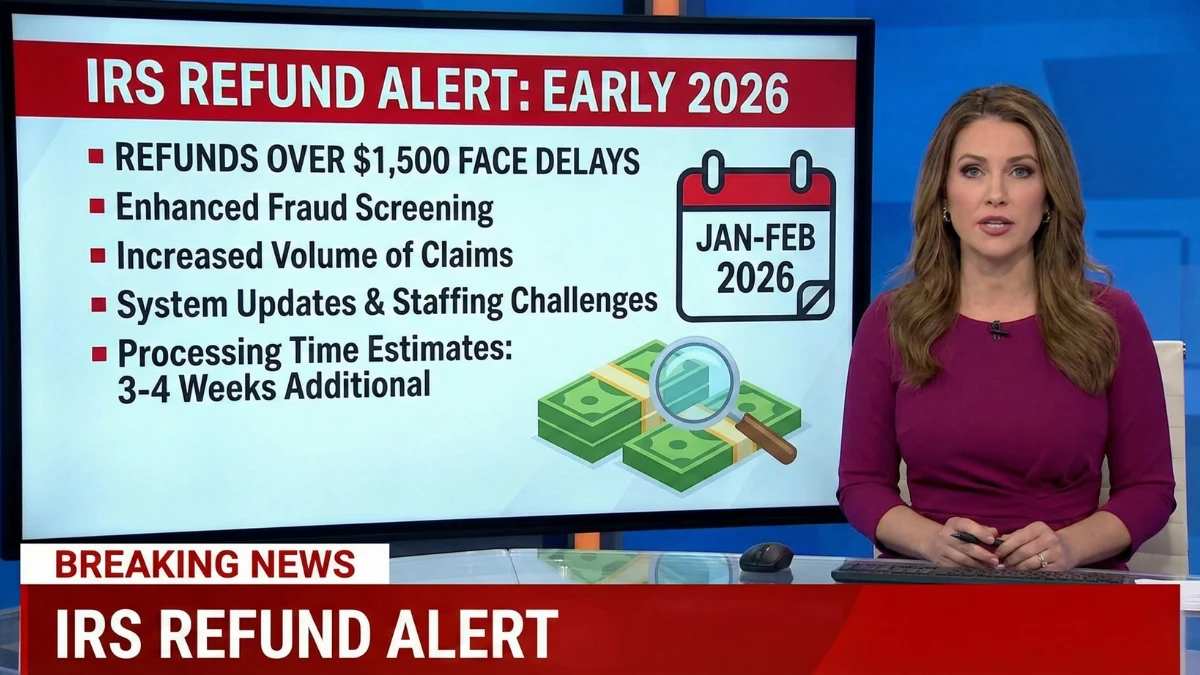

Why Federal Deposits Near $2,000 Often Face Manual IRS Checks

Taxpayers expecting federal deposits near $2,000 are increasingly noticing slower processing and additional review steps, leading to questions about why these amounts attract closer attention. This article explains how and why the Internal Revenue Service routes certain refunds for manual checks, what triggers these reviews, and what filers should realistically expect during the process. Why … Read more