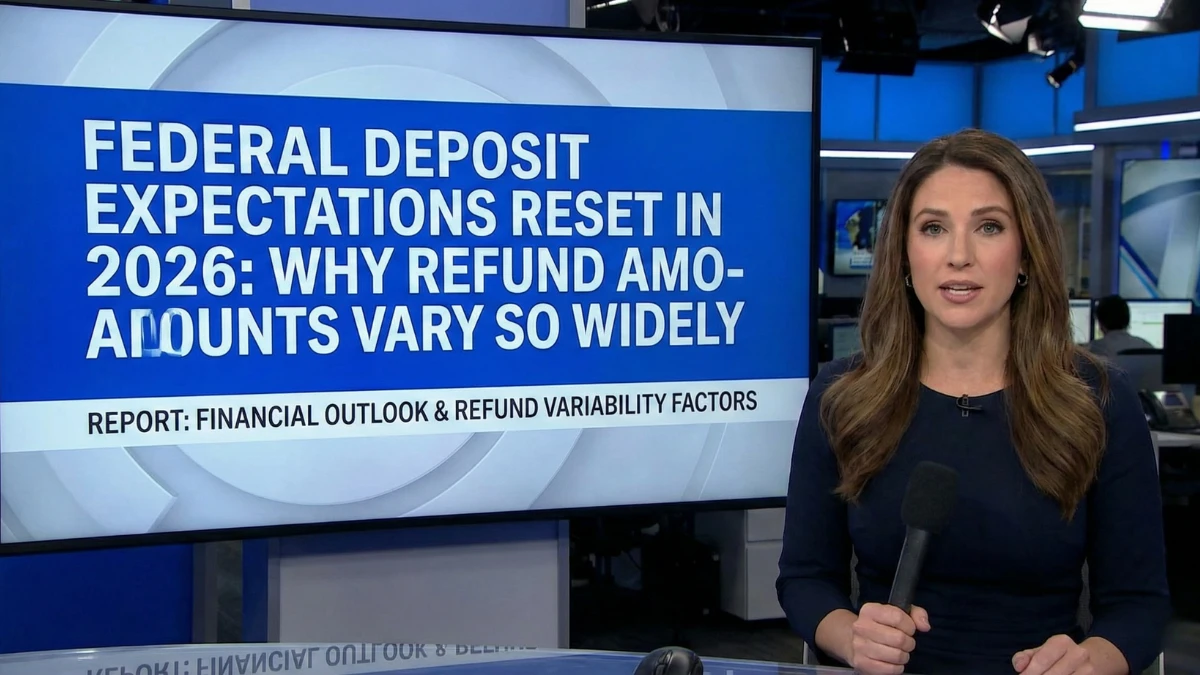

Federal Deposit Expectations Reset in 2026: Why Refund Amounts Vary So Widely

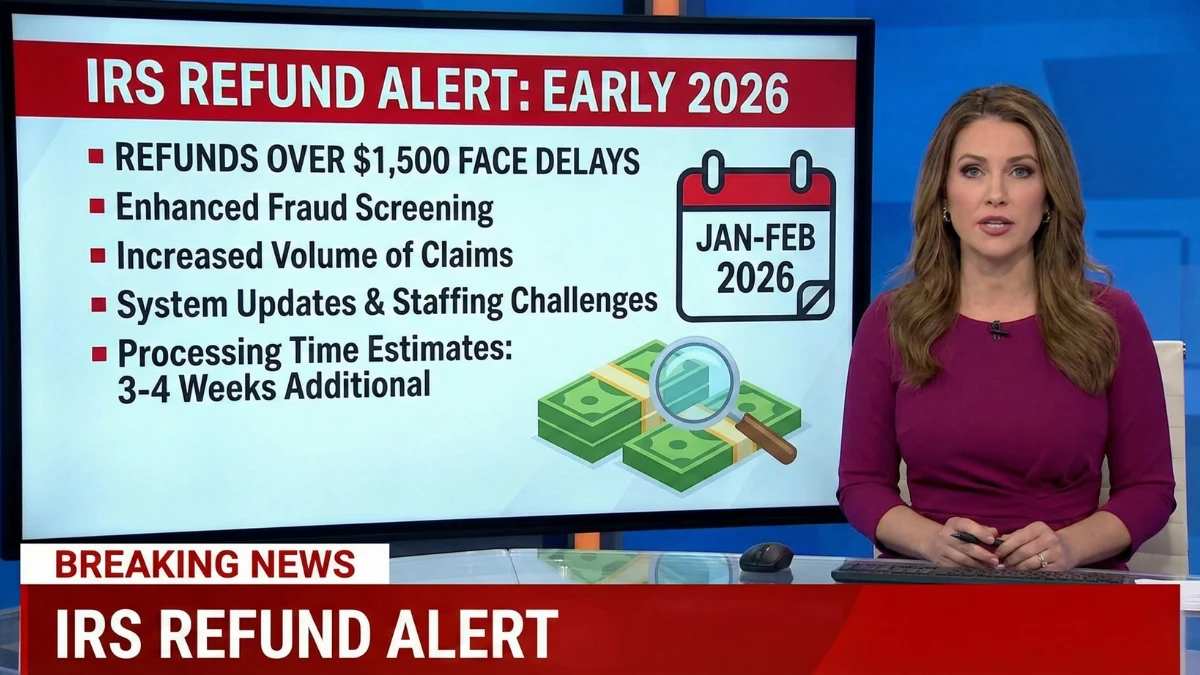

As the 2026 tax season unfolds, many Americans are resetting expectations around federal deposits, discovering that refund amounts differ widely even among filers with similar incomes. Confusion stems from changes in withholding habits, credit eligibility, and processing paths. This article explains why refunds vary so much in 2026, how the Internal Revenue Service calculates and … Read more