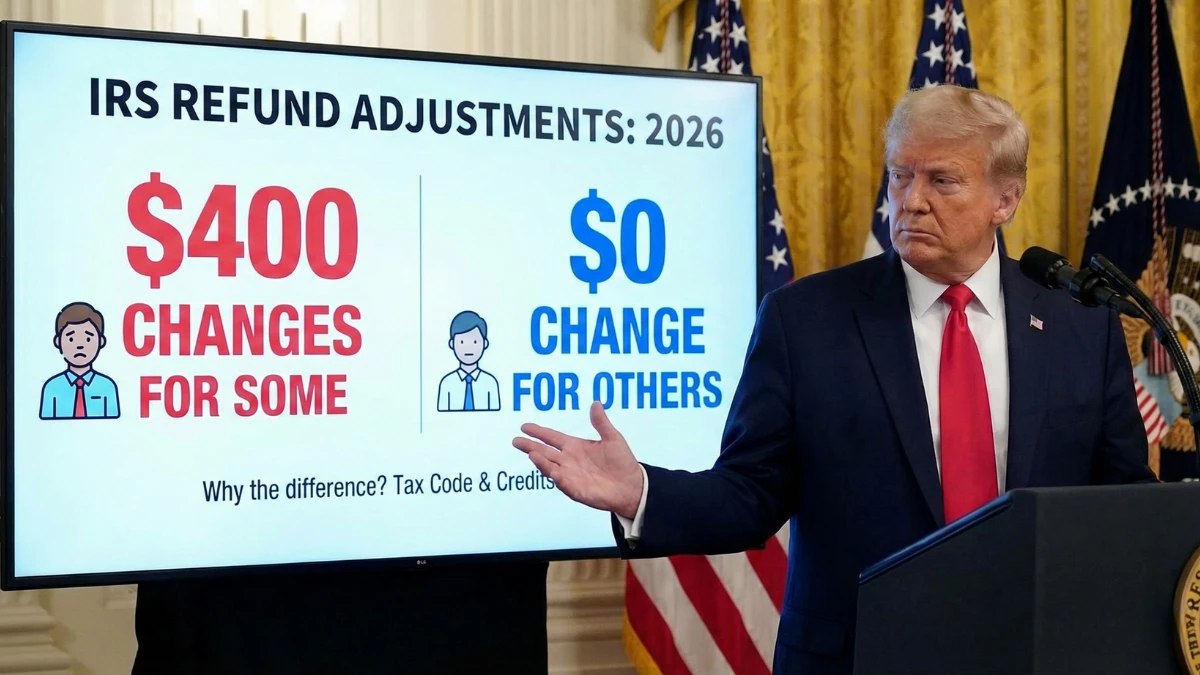

IRS Refund Adjustments Appear in 2026: Why Some Taxpayers See $400 Changes While Others Don’t

In the 2026 tax season, a growing number of filers are noticing IRS refund adjustments of around $400, while others with similar returns see no change at all. These differences are causing confusion and concern, especially when refunds are reduced or increased without obvious explanation. This article explains why refund adjustments happen, how the Internal … Read more