IRS Payment Tracker Usage Surges as Filers Await $2,000 Refunds

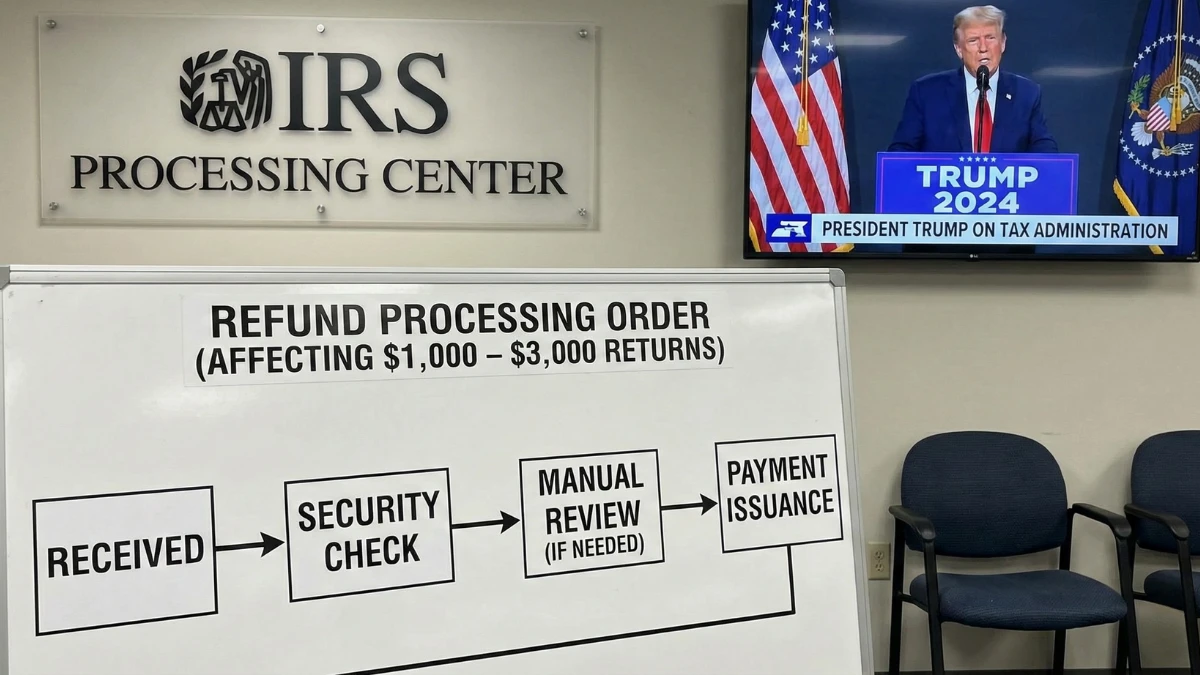

As tax season activity intensifies, usage of the IRS payment and refund tracking tools is surging, especially among filers expecting around $2,000 in refunds. Many taxpayers are checking statuses daily to understand approval timing, bank deposits, and possible delays. This article explains why tracker usage is rising, how the Internal Revenue Service processes refunds, and … Read more